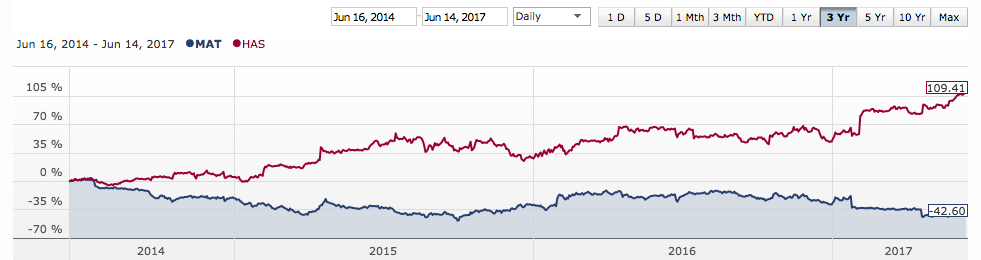

Three years ago I posted on The Motley Fool about two toy companies, Mattel (MAT) and Hasbro (HAS). The post was called Invest Like a Girl, an American Girl. I compared those two to see which was a better stock to buy at the time. In the end, I came to the conclusion that Mattel was. It had a higher dividend, higher ROE, and higher margins, and lower debt and a lower P/E ratio. Those numbers would an obvious buying point right there, but looking at those two competitors now, investors would come to a much different conclusion.

Since then, Mattel lost a deal with Disney concerning the production of their Disney princess dolls. That meant large sums of money that Mattel could have earned was earned by Hasbro. Lucky for Hasbro, a new movie, Frozen just came out. The popularity of earlier princesses along with the new found love for Elsa, Anna and Olaf made Hasbro’s sales skyrocket. Along with that, Hasbro had the long held contract with Star Wars to produce their toys. With Episode VII - The Force Awakens that had just come out in 2015, and another that was soon to come in 2017, Episode VIII - The Last Jedi, Hasbro couldn’t have wished for more.

Stocks

|

P/E Ratio

|

Yield

|

Net Margin

|

ROE

|

Debt

|

EPS

|

Mattel (July 2015)

|

12.7

|

3.73%

|

13.3%

|

27.8%

|

0.5

|

1.08

|

Mattel (June 2017)

|

27.7

|

6.86%

|

5.19%

|

11.8%

|

0.9

|

0.80

|

Looking at the data of then versus now you can see that there is a difference. Mattel had kept its dividend payout going over the past three years, but recently, Mattel’s new CEO Margo Georgiadis said that they are lowering their dividend payout ratio from 160% to between 50-60%. Mattel will end up paying shareholders a 15 cent per share dividend compared to their previous 38 cent per share dividend. Georgiadis will use this money to modernize products and Mattel’s brand. She plans to build websites, video games and other online services to go along with almost all of Mattel’s toys to keep up with the generation. I believe this will help with another target audience along with maintain their current customers which will be helpful for business. Mattel’s new interest in expanding their technology side of the business is tracked back to their new CEO. Georgiadis recently joined Mattel’s executives from Google.

Stocks

|

P/E Ratio

|

Yield

|

Net Margin

|

ROE

|

Debt

|

EPS

|

Hasbro (July 2015)

|

13.4

|

3.01%

|

7.9%

|

21.3%

|

0.6

|

3.57

|

Hasbro (June 2017)

|

24.3

|

1.92%

|

11.34%

|

33.0%

|

0.6

|

4.50

|

Hasbro has had success with the movie business. They continue to make deals with up and coming movies and are still maintaining contracts with Disney and Star Wars.

Stocks

|

P/E Ratio

|

Yield

|

Net Margin

|

ROE

|

Debt

|

Hasbro (June 2017)

|

24.3

|

1.92%

|

11.34%

|

33.0%

|

0.6

|

Mattel (June 2017)

|

27.7

|

6.86%

|

5.19%

|

11.8%

|

0.9

|

As NYU’s Aswath Damodaran, believes a good valuation is made with a story and numbers. You need both to find the right stock. What I lacked when I did my valuation was the story. I had the numbers, but I didn’t predict Hasbro’s successes because I didn’t know a new Star Wars movie was going to come out, or about Mattel losing the Disney princess deal.

Comparing the two companies now, I would say both are fair game for investors. Hasbro has jumped ahead of Mattel with yet another Star Wars movie and more Disney princess movies to come they will hopefully continue on their path. Mattel, with their new CEO, Margo Georgiadis, they too have an exciting future. She is upping their technology game to make sure Mattel stays new and improved. They still have many well known and popular brands. Both companies have potential in future that shine through on both their numbers and story. So, although, my prediction for those two companies was off, all investors make mistakes; I just have to let it go.

Comments

Post a Comment